When it comes to Term vs Whole Life Insurance Quotes: Which Is Better for You?, get ready for a deep dive into the world of insurance choices. This comparison will shed light on the nuances that can impact your financial future.

Exploring the differences and benefits of both term and whole life insurance will provide valuable insights to help you make an informed decision.

Introduction to Term vs Whole Life Insurance Quotes

When it comes to insurance, one of the key decisions you'll need to make is whether to choose term life insurance or whole life insurance. Understanding the differences between these two types of insurance can help you make an informed decision that aligns with your financial goals and needs.

Before making a decision, it's crucial to compare insurance quotes for both term and whole life insurance. This comparison allows you to assess the costs, benefits, and coverage offered by each type of insurance, helping you determine which option best fits your financial situation and long-term objectives.

Distinguishing Term and Whole Life Insurance

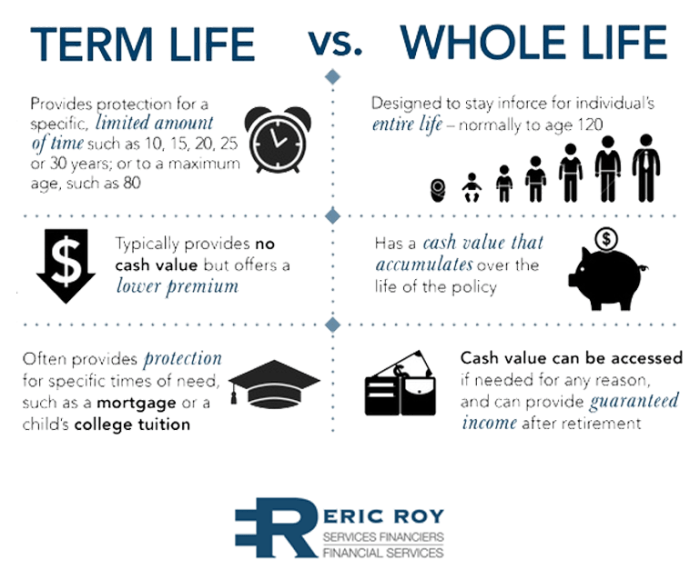

Term Life Insurance:

- Provides coverage for a specific period, such as 10, 20, or 30 years

- Offers lower premiums compared to whole life insurance

- Does not accumulate cash value

- Typically chosen for temporary needs or to cover specific financial obligations

Whole Life Insurance:

- Provides coverage for your entire life

- Has higher premiums but offers a cash value component that grows over time

- Can be used as an investment vehicle due to the cash value accumulation

- Offers lifelong coverage and a guaranteed death benefit

Key Factors to Consider

- Your financial goals and budget

- The length of coverage you need

- Your long-term financial obligations, such as mortgage payments or college tuition

- Your risk tolerance and investment preferences

- The importance of having a cash value component in your policy

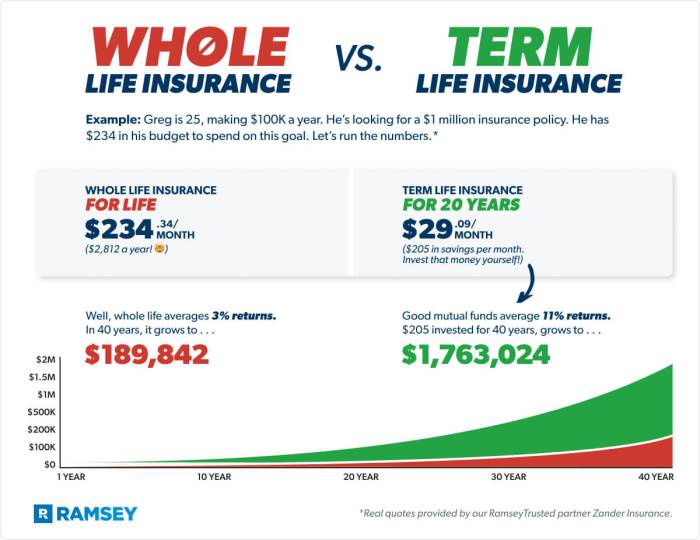

Cost Analysis

When comparing term and whole life insurance, one of the key factors to consider is the cost difference between the two. Understanding how premiums vary for each type of insurance can help you make an informed decision based on your financial goals and needs.Term life insurance typically offers lower premiums compared to whole life insurance.

This is because term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, while whole life insurance covers you for your entire life. As a result, the cost of term life insurance is generally more affordable, making it a popular choice for individuals looking for temporary coverage.On the other hand, whole life insurance tends to have higher premiums due to its lifelong coverage and cash value component.

While the premiums may be higher, whole life insurance offers the benefit of accumulating cash value over time, which can be used as a savings vehicle or for other financial needs.

Premium Examples

- For a 35-year-old non-smoking male, a $500,000 20-year term life insurance policy may cost around $20-$30 per month, whereas a whole life insurance policy with the same coverage could cost $200-$300 per month.

- For a 45-year-old non-smoking female, a $250,000 30-year term life insurance policy may cost $50-$70 per month, while a whole life insurance policy with the same coverage could cost $400-$500 per month.

Financial Implications

While term life insurance may be more cost-effective in the short term, it's essential to consider the long-term financial implications of the cost difference between term and whole life insurance. Whole life insurance provides lifelong coverage and the potential for cash value accumulation, which can benefit you and your beneficiaries in the future.

On the other hand, term life insurance may be a more affordable option for those looking for temporary coverage without the need for cash value accumulation.

Coverage and Flexibility

When it comes to choosing between term and whole life insurance, understanding the coverage and flexibility offered by each type is crucial in making an informed decision.Term Life Insurance:Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years.

During this period, if the policyholder passes away, their beneficiaries receive a death benefit. However, once the term expires, the coverage ends, and there is no cash value accumulation.Whole Life Insurance:Whole life insurance, on the other hand, offers coverage for the entire lifetime of the insured individual.

In addition to the death benefit, whole life policies also accumulate cash value over time, which can be accessed through loans or withdrawals. This provides a level of flexibility in terms of using the policy for financial needs while still maintaining coverage.

Coverage Offered by Term Life Insurance

- Provides coverage for a specific term, typically 10 to 30 years.

- Offers a death benefit to beneficiaries if the insured passes away during the term.

- Generally more affordable compared to whole life insurance.

- Does not accumulate cash value.

Flexibility of Whole Life Insurance

- Coverage lasts for the lifetime of the insured individual.

- Accumulates cash value over time that can be accessed through loans or withdrawals.

- Offers a death benefit along with cash value benefits.

- Premiums remain level throughout the policy's lifetime.

Comparison of Benefits and Drawbacks

- Term life insurance is more affordable but does not offer cash value accumulation.

- Whole life insurance provides lifelong coverage and cash value benefits but comes with higher premiums.

- Term insurance is suitable for covering temporary needs, while whole life insurance can serve as a long-term financial planning tool.

- Choosing between the two depends on individual financial goals and needs.

Investment and Cash Value

When it comes to whole life insurance, one key feature that sets it apart from term life insurance is the ability to build cash value over time. This cash value grows tax-deferred and can be accessed through policy loans or withdrawals while you are still alive.

How Whole Life Insurance Builds Cash Value

Whole life insurance policies allocate a portion of your premium payments towards a cash value account. This cash value accumulates over time based on a guaranteed interest rate set by the insurance company. As you continue to pay premiums, the cash value grows, providing a financial cushion that you can tap into if needed.

- Policy loans: You can borrow against the cash value of your whole life insurance policy at a relatively low interest rate. This can be a valuable source of funds for emergencies or major expenses.

- Withdrawals: You can also make partial withdrawals from the cash value of your policy, although this can reduce the death benefit and potentially trigger taxes if not done correctly.

It's important to note that any outstanding loans or withdrawals will reduce the death benefit paid to your beneficiaries upon your passing.

Investment Components of Whole Life Insurance

Whole life insurance combines insurance coverage with a savings/investment component. A portion of your premium payments goes towards the cash value account, which is invested by the insurance company in a conservative manner such as bonds or money market accounts.

This investment component helps the cash value grow over time.

Potential Returns of Investing in Whole Life Insurance

While whole life insurance provides a guaranteed return on the cash value, the growth is typically modest compared to other investment options such as stocks, mutual funds, or real estate. It's essential to weigh the potential returns of investing in whole life insurance against the risk and returns of other investment vehicles to determine if it aligns with your financial goals.

Duration and Renewability

When it comes to life insurance, understanding the duration of coverage and the renewability options is crucial for making a well-informed decision about your financial future.

Term Life Insurance Duration

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. Once the term ends, the policy expires, and coverage ceases unless renewed or converted to a whole life policy.

Renewability Options

Term life insurance policies may offer the option to renew at the end of the term, but the premiums are likely to increase significantly based on your age and health at the time of renewal. It's important to consider the potential financial implications of renewing a term policy versus purchasing a new one.Whole life insurance policies, on the other hand, do not have an expiration date and provide coverage for your entire lifetime as long as premiums are paid.

This means you won't have to worry about the policy expiring or needing to renew at a higher cost later on.

Implications on Long-Term Financial Planning

The duration and renewability of a life insurance policy can have a significant impact on your long-term financial planning. Term life insurance may be more cost-effective in the short term, but renewing a policy or purchasing a new one later in life can be much more expensive.

Whole life insurance offers the benefit of lifetime coverage without the need for renewal, providing a stable and predictable option for long-term financial security.

Final Wrap-Up

In conclusion, understanding the intricacies of Term vs Whole Life Insurance Quotes: Which Is Better for You? is crucial to securing your financial well-being. By weighing the costs, coverage, and long-term implications, you can choose the insurance that aligns best with your needs.

Expert Answers

What is the main difference between term and whole life insurance?

The main difference lies in the duration of coverage and the ability to build cash value over time.

How do premiums vary between term and whole life insurance?

Premiums for term insurance are typically lower initially compared to whole life insurance, which can have higher premiums.

Which type of insurance offers more flexibility in coverage and benefits?

Whole life insurance offers more flexibility in coverage and benefits compared to term life insurance.

What are the long-term financial implications of choosing between term and whole life insurance?

The choice between term and whole life insurance can significantly impact your financial planning and future security.