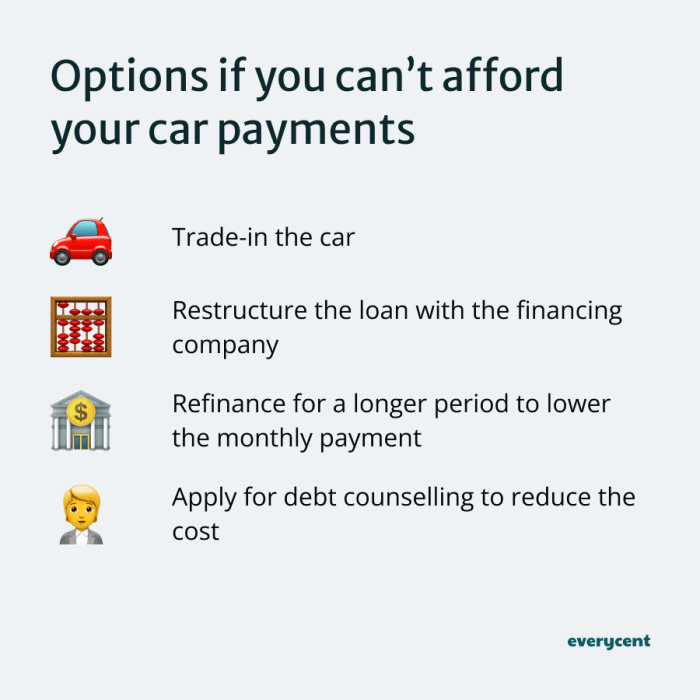

Exploring ways to legally reduce your car finance monthly payment opens up a world of possibilities. From renegotiating terms to effective budgeting, this guide will walk you through the steps to achieve financial flexibility while staying within the legal boundaries.

When it comes to managing your car finance, understanding the options available can make a significant impact on your monthly expenses. Let's dive in and uncover the secrets to lowering your car finance payment legally.

Legal Ways to Lower Your Car Finance Monthly Payment

When facing financial constraints, it's crucial to explore legal strategies to reduce your car finance payments without falling into potential pitfalls. Understanding the terms of your car finance agreement is key to navigating the process effectively.

Renegotiating Interest Rates or Loan Terms

- Reach out to your lender to discuss the possibility of lowering your interest rate or extending the loan term.

- Highlight any changes in your financial situation or credit score that could warrant a review of your current terms.

- Be prepared to negotiate and provide evidence to support your request for a lower monthly payment.

Refinancing Your Car Loan

- Consider refinancing your car loan with a different lender to secure a lower interest rate and subsequently reduce your monthly payments.

- Compare offers from multiple lenders to ensure you're getting the best deal possible.

- Keep in mind that refinancing may come with certain fees, so calculate the overall savings before proceeding.

Budgeting Tips for Lowering Car Finance Payments

Budgeting plays a crucial role in managing car finance payments effectively. By creating a detailed budget, you can prioritize expenses and allocate funds towards your car payments, ensuring that you stay on track with your financial obligations. Let's explore some budgeting tips to help you lower your car finance payments.

Effectively Prioritizing Expenses

- Start by listing all your monthly expenses, including necessities such as rent, utilities, groceries, and debt payments.

- Identify areas where you can cut back on spending, such as dining out, entertainment, or subscription services.

- Allocate a specific amount towards your car payment each month to ensure it is a top priority.

Reducing Discretionary Spending

- Consider cutting back on non-essential expenses to free up more funds for your car payments.

- Avoid impulse purchases and focus on saving money wherever possible.

- Look for ways to reduce costs, such as carpooling or finding more affordable alternatives for your daily needs.

Setting Financial Goals

- Establish clear financial goals for lowering your car finance payments, such as paying off a certain amount of the principal each month.

- Track your progress regularly and make adjustments to your budget as needed to stay on target.

- Consider refinancing your car loan or negotiating with your lender to lower your monthly payments further.

Negotiation Strategies with Lenders

Negotiating with lenders is a crucial step in lowering your car finance payments. By effectively communicating with your lender and exploring payment reduction options, you can potentially save money in the long run. Here are some strategies to help you negotiate successfully:

Leverage Good Payment History or Credit Score

- Highlight your good payment history: Emphasize your track record of making on-time payments to demonstrate your reliability as a borrower.

- Showcase your credit score: A good credit score can work in your favor during negotiations, as it reflects your creditworthiness and ability to manage debt responsibly.

- Use these factors to negotiate: Politely remind your lender of your positive payment history and credit score to strengthen your position and potentially secure a lower monthly payment.

Effective Communication Strategies

- Be polite and respectful: Approach the negotiation process with a positive attitude and maintain a respectful tone throughout the conversation.

- Clearly state your request: Clearly articulate your desire to lower your monthly payment and explain why it is important to you.

- Listen actively: Pay attention to your lender's responses and be open to exploring different options to reach a mutually beneficial agreement.

Successful Negotiation Tactics

- Research current rates: Familiarize yourself with current interest rates and loan terms to support your negotiation strategy.

- Be prepared to walk away: If the lender is unwilling to negotiate, be prepared to explore other options or consider refinancing with a different lender.

- Seek professional assistance: If you are unsure how to negotiate effectively, consider seeking help from a financial advisor or credit counselor to guide you through the process.

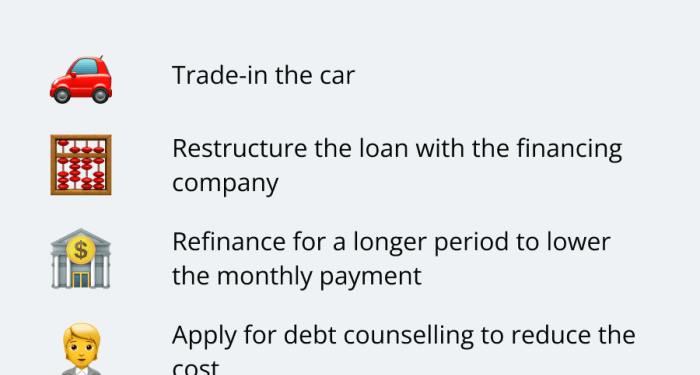

Understanding Loan Modification Options

When facing challenges with your car finance payments, understanding the loan modification options available to you can provide a potential solution to ease the financial burden.

Types of Loan Modifications

- Interest Rate Reduction: One common form of loan modification is negotiating a lower interest rate with your lender. This can significantly reduce your monthly payments over the life of the loan.

- Term Extension: Extending the term of your loan allows you to spread out the payments over a longer period, resulting in lower monthly payments. However, keep in mind that this may increase the total amount of interest paid over time.

- Principal Forbearance: In some cases, lenders may agree to temporarily reduce or suspend a portion of the principal amount owed, lowering the monthly payments for a specific period.

Applying for Loan Modification

When considering a loan modification, it is essential to communicate with your lender to discuss your financial situation openly. You will likely need to provide documentation such as income statements, expenses, and a hardship letter explaining the reasons for your request.

Impact of Loan Modifications

- Lower Monthly Payments: Loan modifications can lead to a reduction in your monthly payments, making it more manageable to meet your financial obligations.

- Extended Loan Term: While extending the loan term can lower monthly payments, it may result in paying more interest over time. Consider the long-term implications before making a decision.

When to Consider Loan Modification

Loan modification can be a viable option in situations such as job loss, unexpected medical expenses, or other financial hardships that make it challenging to meet your current payment obligations. It is essential to act promptly and explore all available options to avoid defaulting on your loan.

Final Thoughts

In conclusion, mastering the art of reducing your car finance monthly payment legally can lead to substantial savings and financial freedom. By utilizing negotiation strategies, budgeting techniques, and exploring loan modification options, you can take control of your finances and drive towards a brighter financial future.

Helpful Answers

How can I renegotiate my car loan terms to lower my monthly payment?

You can contact your lender to discuss the possibility of renegotiating your interest rates or extending the loan term to lower your monthly payments.

Is refinancing a car loan a viable option to reduce monthly payments?

Refinancing your car loan can be a viable option to achieve lower monthly payments by obtaining a new loan with better terms and interest rates.

What role does credit score play in negotiating lower car finance payments?

A good credit score can be leveraged during negotiations with lenders to potentially secure lower interest rates or payment reduction options.

How do loan modifications impact monthly car finance payments?

Loan modifications can impact monthly payments by adjusting loan terms, such as extending the loan period or reducing interest rates, to make payments more manageable.