When it comes to comparing auto insurance quotes, finding the best company can make a significant impact on your coverage and savings. Dive into the world of auto insurance comparison and discover which company truly stands out among the rest.

Factors to Consider When Comparing Auto Insurance Quotes

When comparing auto insurance quotes, it's crucial to consider various factors that can significantly impact the overall value of your coverage. These factors include coverage options, deductibles, premiums, and discounts. Each of these elements plays a vital role in determining the cost and extent of protection offered by an insurance policy.

Coverage Options

Different insurance companies may offer varying coverage options, such as liability, collision, comprehensive, uninsured motorist, and personal injury protection. It's essential to assess your individual needs and select a policy that provides adequate coverage for your specific situation.

Deductibles

Deductibles refer to the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible typically results in lower premiums, while a lower deductible usually leads to higher premiums. Consider your financial situation and risk tolerance when deciding on the deductible amount.

Premiums

Premiums are the recurring payments you make to maintain your insurance coverage. They can vary significantly between insurance companies based on factors like your driving record, age, location, and the type of vehicle you drive. Compare premium quotes from different providers to find the most competitive rates.

Discounts

Many insurance companies offer discounts for various reasons, such as being a safe driver, bundling policies, having anti-theft devices in your vehicle, or completing a defensive driving course. Take advantage of these discounts to reduce your overall insurance costs.

Researching Auto Insurance Companies

When comparing auto insurance quotes, it is crucial to research the background and reputation of the insurance companies you are considering. This step helps ensure that you choose a reliable and trustworthy provider for your coverage needs.

List of Reputable Auto Insurance Companies

- State Farm

- Geico

- Progressive

- Allstate

- USAA

Process of Researching Financial Stability and Customer Service Reputation

Before making a decision, it is important to assess the financial stability and customer service reputation of each auto insurance company. This can be done by:

- Checking the financial strength ratings provided by agencies like A.M. Best, Moody's, and Standard & Poor's.

- Reviewing customer complaints and satisfaction ratings on websites like the Better Business Bureau and J.D. Power.

- Researching the company's history of handling claims efficiently and fairly.

- Reading reviews and testimonials from current and former policyholders.

Impact of Customer Reviews and Ratings

Customer reviews and ratings play a significant role in the decision-making process when choosing an auto insurance company. Positive reviews can indicate excellent customer service, easy claims processes, and overall satisfaction. On the other hand, negative reviews may highlight issues with claim denials, poor communication, or premium increases.

Obtaining Quotes from Multiple Companies

When it comes to comparing auto insurance quotes, obtaining quotes from multiple companies is essential to ensure you are getting the best deal. Here's how you can go about it:

Requesting Auto Insurance Quotes

- Start by researching reputable insurance companies in your area.

- Visit the websites of these companies or contact them directly to request a quote.

- Provide consistent information such as your driving history, vehicle details, and coverage needs to each company.

- Be prepared to answer questions about your driving habits and any past claims.

Ensuring Accuracy and Comparability

- Double-check all the information you provide to ensure accuracy and consistency across all quotes.

- Make sure you are requesting quotes for the same coverage types and limits to make a fair comparison.

- Ask each company to include any discounts you may qualify for to get a better idea of the final pricing.

Reviewing Each Quote Carefully

- Once you receive quotes from multiple companies, review each one carefully.

- Look for any variations in coverage, deductibles, and pricing.

- Consider the reputation and customer service of each company in addition to the quote itself.

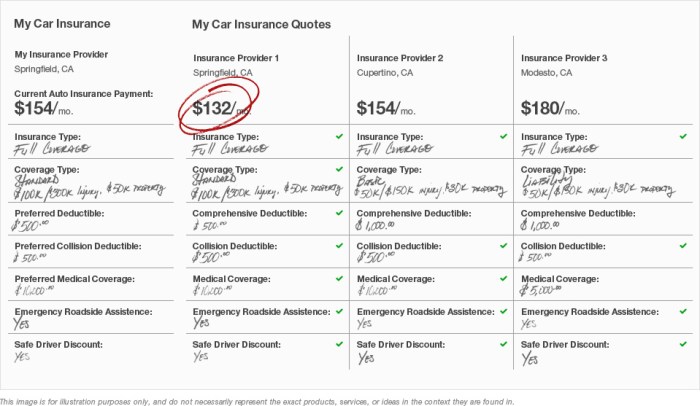

Comparing Quotes Effectively

When comparing auto insurance quotes, it is essential to analyze them side by side to identify the differences and make an informed decision. This involves creating a table with columns for each company's quote, coverage details, and pricing.

Analyzing and Comparing Quotes

- Start by organizing the quotes in a table format, listing each company's quote along with the coverage details such as deductibles, limits, and types of coverage offered.

- Compare the pricing for each quote, ensuring that you are comparing similar coverage levels to get an accurate comparison.

- Look for any additional benefits or discounts offered by each company that may affect the overall value of the policy.

- Pay attention to any exclusions or limitations in the coverage that may impact your decision.

Tips for Interpretation

- Consider the overall value of the policy, not just the price. A slightly higher premium may be worth it if the coverage and benefits are more comprehensive.

- Read the fine print of each quote to understand any terms and conditions that may apply, especially regarding claims processes and coverage exceptions.

- Take note of any customer reviews or ratings for each company to gauge their reputation for customer service and claims handling.

- Don't hesitate to reach out to the insurance companies directly to ask any questions or clarify any details before making your final decision.

Additional Considerations in Choosing the Best Auto Insurance Company

When choosing the best auto insurance company, there are several additional considerations beyond just the quotes that can impact your overall satisfaction with the coverage you receive. Factors such as customer support, claims process, and ease of policy management can play a significant role in your experience as a policyholder.

Customer Support and Claims Process

- Customer support: A responsive and helpful customer support team can make a big difference when you need assistance with your policy or have questions about your coverage.

- Claims process: A smooth and efficient claims process is crucial during stressful times like accidents. Look for companies known for their hassle-free claims handling.

Add-On Features and Policy Management

- Add-on features: Consider the availability of extra features like roadside assistance or accident forgiveness. These can provide added value and peace of mind in unexpected situations.

- Policy management: Evaluate how easy it is to manage your policy online, make changes, or access important documents. A user-friendly interface can simplify your insurance experience.

Weighing Considerations Against Quote Comparison

While price is important, it's equally crucial to consider these additional factors when choosing an auto insurance company. A slightly higher quote from a company with excellent customer service and convenient policy management may be worth the investment.

Epilogue

As we conclude our exploration of auto insurance companies and quote comparisons, it becomes evident that choosing the best one requires a careful evaluation of various factors. Armed with this knowledge, you can confidently navigate the realm of auto insurance and secure the ideal policy for your needs.

Quick FAQs

What factors should I consider when comparing auto insurance quotes?

Key factors include coverage options, deductibles, premiums, and discounts. Each factor can significantly impact the overall value of an insurance policy.

How can I ensure accurate quotes when obtaining them from multiple companies?

To ensure accuracy, provide consistent information when requesting quotes and carefully review each offer for variations in coverage and pricing.

What additional considerations should I keep in mind when choosing the best auto insurance company?

Factors like customer support, claims process efficiency, and add-on features such as roadside assistance should also be weighed alongside quote comparisons.