Starting with Auto Insurance Deductibles Explained: What You Should Know, the topic delves into a detailed exploration that aims to inform and engage readers effectively.

The following paragraph will provide a comprehensive and informative overview of auto insurance deductibles.

Understanding Auto Insurance Deductibles

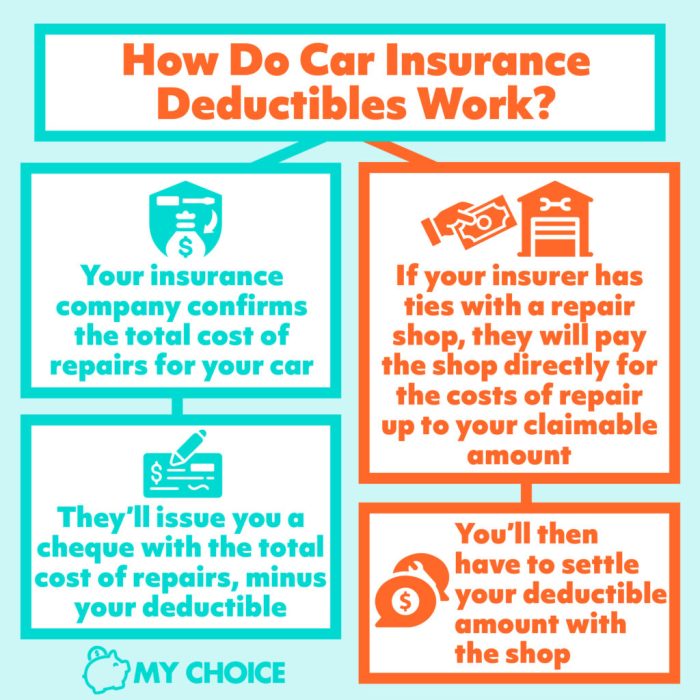

Auto insurance deductibles are the amount of money you agree to pay out of pocket before your insurance coverage kicks in to cover a claim. It's essentially your financial responsibility in case of an accident or damage to your vehicle.

Deductibles work by allowing you to choose an amount that you are comfortable paying in the event of a claim. Typically, the higher the deductible you choose, the lower your insurance premium will be. Conversely, a lower deductible will result in a higher premium.

Examples of Different Deductible Amounts

- $500 Deductible:If you have a $500 deductible and file a claim for $3,000 in damages, you would pay $500 out of pocket, and your insurance would cover the remaining $2,500.

- $1,000 Deductible:With a $1,000 deductible and the same $3,000 claim, you would pay $1,000, and your insurance would cover $2,000.

- $2,000 Deductible:Choosing a $2,000 deductible means you would pay $2,000 in the event of a claim totaling $3,000, leaving the insurance to cover only $1,000.

Deductibles directly impact your insurance premiums. Opting for a higher deductible can lower your premium since you are taking on more of the risk. However, be sure to choose a deductible amount that you can comfortably afford to pay out of pocket if needed.

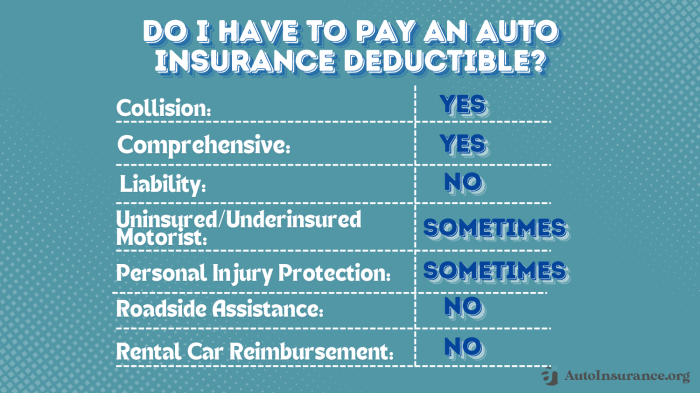

Types of Auto Insurance Deductibles

When it comes to auto insurance deductibles, there are several types to consider. Each type has its own set of pros and cons, and understanding them can help you make an informed decision about which one is right for you.

Fixed Deductible

A fixed deductible is a set amount that you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 fixed deductible and you file a claim for $2000 in damages, you would pay $500 and your insurance would cover the remaining $1500.

- Pros:Predictable costs, easy to understand.

- Cons:Higher upfront costs, may not be cost-effective for low-value claims.

A fixed deductible can be beneficial for those who prefer knowing exactly how much they need to pay in the event of a claim and are comfortable with higher upfront costs.

Percentage Deductible

A percentage deductible is based on a percentage of the total claim amount. For example, if you have a 10% deductible and file a claim for $2000, you would pay $200 (10% of $2000) and your insurance would cover the remaining $1800.

- Pros:Adjusts with claim amount, can be cost-effective for high-value claims.

- Cons:Potentially higher out-of-pocket costs for expensive claims.

A percentage deductible can be beneficial for those who want their deductible amount to scale with the claim amount, especially for more costly repairs or replacements.

Split Deductible

A split deductible involves different deductible amounts for different types of claims. For example, you may have a lower deductible for collision coverage and a higher deductible for comprehensive coverage.

- Pros:Tailored coverage for different types of risks, potentially lower costs for specific types of claims.

- Cons:Could lead to confusion, may require more management.

A split deductible can be beneficial for those who want to customize their coverage based on the types of risks they are most concerned about, allowing for more control over their out-of-pocket expenses.

Factors Influencing Auto Insurance Deductibles

When it comes to auto insurance deductibles, there are several factors that can influence the amount you pay out of pocket in the event of a claim. Understanding these factors can help you make informed decisions when choosing your deductible amount.

Driving History

Your driving history plays a significant role in determining your auto insurance deductible. If you have a history of accidents or traffic violations, insurance companies may consider you a higher risk driver. As a result, they may require you to have a higher deductible to offset the increased likelihood of you filing a claim.

Type of Vehicle

The type of vehicle you drive can also impact your deductible choices. High-performance or luxury vehicles may come with higher deductibles due to the potentially higher cost of repairs or replacement parts. On the other hand, more affordable or common vehicles may have lower deductibles since they are generally cheaper to repair.

Location and Coverage Levels

Where you live and the coverage levels you choose can also affect your auto insurance deductible. Drivers in urban areas or regions prone to severe weather conditions may face higher deductibles to account for increased risk. Additionally, the amount of coverage you select, such as comprehensive or collision coverage, can impact your deductible amount.

Tips for Managing Auto Insurance Deductibles

When it comes to managing auto insurance deductibles, there are several strategies you can use to save money, adjust your deductible amounts, and make informed decisions. Here are some tips to help you navigate the world of auto insurance deductibles effectively.

Saving Money on Deductibles

- Consider opting for a higher deductible amount. While this means you'll have to pay more out of pocket in the event of a claim, it can significantly lower your monthly premiums.

- Look for discounts or offers from insurance providers that can help reduce your deductible or overall insurance costs.

- Maintain a clean driving record to qualify for lower deductibles and better rates.

Adjusting Deductible Amounts

- Review your budget and financial situation to determine the most suitable deductible amount for your needs. Consider how much you can comfortably afford to pay in case of an accident.

- If you have savings set aside for emergencies, you may feel more comfortable selecting a higher deductible to lower your premiums.

Effect of Bundling Policies

- Bundle your auto insurance policy with other insurance policies, such as home or renters insurance, to potentially qualify for a lower deductible or receive discounts on your premiums.

- Combining policies with the same insurer can lead to savings and convenience by managing all your insurance needs in one place.

When to Adjust Deductibles

- Consider raising your deductible if you have a good driving record and can afford a higher out-of-pocket expense in case of an accident. This can lead to lower premiums over time.

- Lower your deductible if you anticipate needing to file a claim soon or if you prefer to have a lower out-of-pocket expense in case of an accident, even if it means paying higher premiums.

Summary

Concluding the discussion on Auto Insurance Deductibles Explained: What You Should Know, a brief summary encapsulates the key points discussed, leaving readers with a clear understanding of the topic.

Q&A

What factors can impact auto insurance deductibles?

Factors such as driving history, type of vehicle, location, and coverage levels can all influence auto insurance deductibles.

How can one save money on deductibles?

Tips for saving money on deductibles include bundling policies, adjusting deductible amounts strategically, and considering when to raise or lower deductibles.

What are the different types of auto insurance deductibles?

Auto insurance deductibles can be fixed, percentage-based, or split, each with its own set of pros and cons.