Exploring the landscape of private health insurance plans in the US for 2025 opens up a world of possibilities and considerations. From historical perspectives to emerging trends, this topic delves into the complexities and nuances of selecting the best coverage for your health needs.

Detailing the different types of plans, factors to keep in mind, and what the future holds for private health insurance, this discussion aims to provide a comprehensive guide for individuals navigating the realm of healthcare options.

Overview of Private Health Insurance Plans in the US 2025

Private health insurance in the US has a long history dating back to the early 20th century when employers started offering health benefits to attract workers. Today, private health insurance plays a crucial role in providing coverage to individuals and families across the country.Key features of private health insurance plans include a variety of coverage options such as hospital stays, doctor visits, prescription drugs, and preventive care.

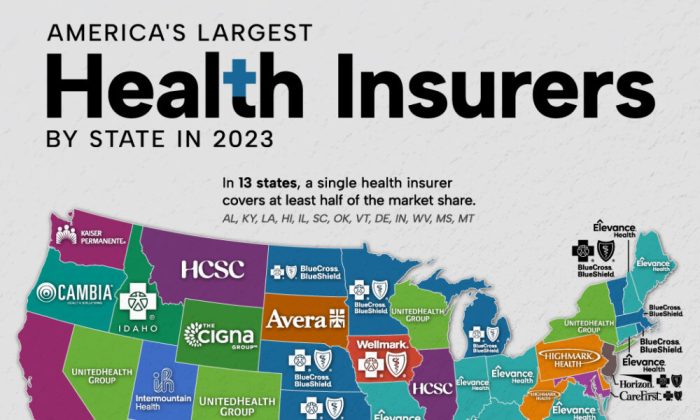

These plans also offer different network options, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs).The current landscape of private health insurance in the US is diverse, with a wide range of plans available to consumers.

Insurance companies compete to offer innovative plans tailored to individuals' needs, with a focus on affordability and comprehensive coverage.

Types of Private Health Insurance Plans

- HMOs: HMOs require members to choose a primary care physician and obtain referrals for specialist care. They often have lower out-of-pocket costs but limited provider networks.

- PPOs: PPOs offer more flexibility in choosing healthcare providers and do not require referrals for specialist care. However, they tend to have higher premiums and out-of-pocket costs.

- EPOs: EPOs combine aspects of HMOs and PPOs by offering a defined network of providers without requiring referrals. They typically have lower premiums than PPOs.

- HDHPs: HDHPs have higher deductibles and lower premiums than traditional plans. They are often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket expenses.

Cost implications vary among private health insurance plans, with factors such as premiums, deductibles, copayments, and coinsurance affecting overall expenses. It is essential for individuals to consider their healthcare needs and budget when choosing a plan

Factors to Consider When Choosing a Private Health Insurance Plan

- Premiums: Monthly costs for coverage.

- Deductibles: Amount individuals must pay out-of-pocket before insurance kicks in.

- Network Coverage: Availability of preferred doctors and hospitals within the plan's network.

- Quality of Care: Evaluate provider ratings and customer satisfaction.

Understanding the fine print in insurance policies is crucial to avoid surprises and ensure coverage meets individual needs. It is recommended to review plan details carefully, including coverage limitations, exclusions, and renewal terms.

Emerging Trends in Private Health Insurance for 2025

- Technology Impact: Advancements in telemedicine and digital health platforms are reshaping how private health insurance plans deliver care and services.

- Personalized Medicine: Tailoring treatment plans based on genetic testing and individual health data is becoming more prevalent, influencing coverage options and costs.

- Regulatory Changes: Policy shifts at the state and federal levels can impact insurance offerings, pricing, and consumer protections in 2025.

Closing Summary

In conclusion, the realm of private health insurance plans in the US for 2025 is vast and dynamic, offering a mix of traditional and innovative approaches to coverage. By staying informed and considering all relevant factors, individuals can make informed decisions to secure the best possible healthcare protection for the future.

Common Queries

What are the key features to look for in private health insurance plans?

Key features to consider include coverage options, network coverage, premiums, and deductibles.

How can one evaluate the quality of a private health insurance plan?

Quality can be assessed by looking at customer reviews, the reputation of the insurance provider, and the comprehensiveness of coverage.

What impact does technology have on private health insurance plans?

Technology influences the accessibility of healthcare services, data management, and personalized medicine options within insurance plans.