Homeowners Insurance Quote Explained: What You’re Really Paying For sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into the intricacies of homeowners insurance quotes, a world of information unfolds, shedding light on the true essence of what policyholders are investing in.

Understanding Homeowners Insurance Quote

When obtaining a homeowners insurance quote, it is essential to understand the various components that make up the total cost. From premiums to coverage limits and deductibles, each factor plays a crucial role in determining the overall quote.

Components of a Homeowners Insurance Quote

- The premium: This is the amount you pay for the insurance policy, typically on a monthly or annual basis.

- Coverage limits: These are the maximum amounts your insurance provider will pay out for covered losses.

- Deductibles: This is the amount you are responsible for paying out of pocket before your insurance kicks in.

- Type of coverage: Different types of homeowners insurance policies, such as HO-1, HO-2, HO-3, and HO-5, offer varying levels of coverage and affect the overall quote.

Calculating Premiums for Homeowners Insurance

- Insurance companies calculate premiums based on various factors, including the value of your home, its location, the coverage options selected, and your claims history.

- Factors like the age of your home, construction materials used, and proximity to fire stations and coastlines can also impact the premium.

- Additionally, your credit score and the presence of safety features in your home, such as smoke alarms and security systems, may influence the cost of your insurance.

Importance of Reviewing Coverage Limits and Deductibles

- It is crucial to review the coverage limits in your homeowners insurance quote to ensure they adequately protect your home and belongings in the event of a loss.

- Similarly, understanding the deductibles will help you determine how much you will need to pay out of pocket before your insurance coverage kicks in.

- Adjusting coverage limits and deductibles can impact the overall cost of your insurance premium.

Comparison of Different Types of Homeowners Insurance Policies

- HO-3 policies are the most common and provide coverage for your dwelling and personal property against a broad range of perils.

- HO-1 and HO-2 policies offer more limited coverage, while HO-5 policies provide comprehensive protection for your home and belongings.

- Understanding the differences between these policies can help you choose the one that best fits your needs and budget.

Coverage Details in Homeowners Insurance

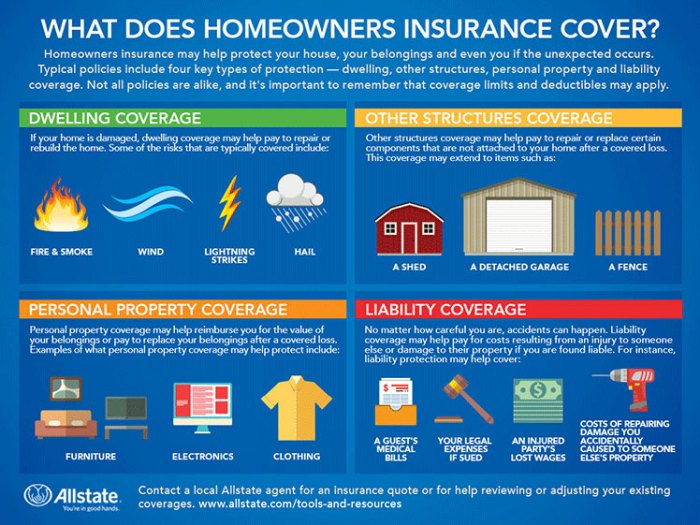

When it comes to homeowners insurance, understanding the coverage details is essential to ensure you have the protection you need. Here, we will dive into the standard coverage items, optional add-ons, liability coverage, and personal property coverage in a homeowners insurance quote.

Standard Coverage Items in Homeowners Insurance Quote

- Dwelling coverage: This protects the structure of your home in case of damage from covered perils like fire, wind, or vandalism.

- Personal property coverage: This helps replace or repair your belongings inside the home if they are damaged or stolen.

- Other structures coverage: Covers structures on your property that are not attached to your home, such as a detached garage or shed.

- Loss of use coverage: Pays for additional living expenses if you cannot live in your home due to a covered loss.

- Medical payments coverage: Covers medical expenses for guests who are injured on your property, regardless of fault.

Optional Coverage Add-ons and Benefits

- Flood insurance: Protects your home and belongings from flood damage, which is not covered under a standard policy.

- Earthquake insurance: Provides coverage for damage caused by earthquakes, a separate policy needed in high-risk areas.

- Scheduled personal property endorsement: Allows you to insure high-value items like jewelry, art, or collectibles beyond the standard limits.

How Liability Coverage Works in a Homeowners Insurance Policy

Liability coverage protects you in case someone is injured on your property or you accidentally damage someone else's property. It can help cover legal fees, medical expenses, and settlements if you are found liable for the damages.

How Personal Property Coverage is Determined in a Quote

Personal property coverage is typically set at a percentage of your dwelling coverage limit. You can also choose to increase this limit if you have valuable items that exceed the standard coverage amount. Make sure to take an inventory of your belongings and their value to ensure you have adequate coverage in place.

Factors Influencing Homeowners Insurance Quote

When it comes to determining the cost of a homeowners insurance quote, several key factors come into play. These factors can significantly impact the final premium you pay for your coverage. Understanding these elements can help you make informed decisions when selecting a homeowners insurance policy.

Location of Home

The location of your home plays a crucial role in determining your insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires typically have higher insurance rates. Additionally, the crime rate and proximity to fire stations can also influence the cost of your homeowners insurance.

Age and Condition of Home

The age and condition of your home are important factors that insurers consider when calculating your insurance quote. Older homes or those in poor condition may have a higher risk of damage or structural issues, leading to increased premiums. Upgrades such as a new roof, updated electrical wiring, or modern plumbing can help lower your insurance costs.

Homeowner's Claims History

Your claims history as a homeowner can impact the insurance quote you receive. If you have a history of filing numerous claims for damages, insurers may view you as a higher risk and charge higher premiums. On the other hand, homeowners with a clean claims history are likely to receive lower insurance rates.

Tips for Getting the Best Homeowners Insurance Quote

When looking to secure the best homeowners insurance quote, there are several strategies you can employ to potentially lower your premiums and maximize your coverage. By understanding the factors that influence insurance costs, you can make informed decisions to get the most value out of your policy.

Consider Bundling Insurance Policies

One effective way to lower your homeowners insurance premium is to bundle it with other insurance policies, such as auto or life insurance. Insurance companies often offer discounts to customers who purchase multiple policies from them, which can result in significant cost savings.

Maintain a Good Credit Score

Another important factor that can impact your homeowners insurance quote is your credit score. Insurance companies use credit information to assess risk and determine premiums. By maintaining a good credit score, you can potentially qualify for lower insurance rates and more favorable quotes.

Accurately Estimate Replacement Cost

When determining the coverage amount for your homeowners insurance policy, it's crucial to accurately estimate the replacement cost of your home. This will ensure that you are adequately covered in the event of a loss. Consider factors such as construction costs, square footage, and additional features of your home to determine an appropriate coverage amount.

Final Summary

In conclusion, the journey through understanding homeowners insurance quotes has been enlightening, revealing the layers of protection and value they offer to homeowners. With this newfound knowledge, navigating the realm of insurance quotes becomes a more informed and empowering experience.

FAQ Overview

What factors can affect the cost of a homeowners insurance quote?

Factors such as the location of the home, age and condition of the property, and the homeowner's claims history can all influence the cost of a homeowners insurance quote.

How can homeowners lower their insurance premiums?

Homeowners can lower their insurance premiums by bundling insurance policies, maintaining a good credit score, and accurately estimating the replacement cost of their home for insurance purposes.

What are some optional coverage add-ons and their benefits?

Optional coverage add-ons can include coverage for expensive jewelry, identity theft protection, and additional living expenses in case of temporary displacement. These add-ons provide extra protection and peace of mind for homeowners.

How is personal property coverage determined in a homeowners insurance quote?

Personal property coverage in a homeowners insurance quote is typically determined based on the estimated value of the belongings inside the home. It's important for homeowners to accurately assess the value of their possessions to ensure adequate coverage.