Embark on a journey to understand the intricacies of comparing life insurance quotes and saving big. This guide aims to provide valuable insights and tips to help you make informed decisions when it comes to securing your financial future.

Delve into the world of life insurance quotes and discover the key factors that can make a significant difference in your premiums and coverage.

Factors to Consider When Comparing Quotes

When comparing life insurance quotes, there are several key factors to consider that can significantly impact the premiums you will pay. These factors include age, health, occupation, lifestyle, coverage amount, and term length.

Factors Affecting Life Insurance Premiums

- Age: Younger individuals typically pay lower premiums as they are considered lower risk. Premiums tend to increase as you age.

- Health: Your current health status and medical history play a crucial role in determining your premiums. Those with pre-existing conditions may face higher costs.

- Occupation: Certain occupations that are considered high-risk may lead to higher premiums due to the increased likelihood of accidents or health issues.

- Lifestyle: Factors such as smoking, excessive alcohol consumption, or participation in hazardous activities can impact your premiums.

Importance of Coverage Amount and Term Length

- Coverage Amount: The amount of coverage you choose will directly affect your premiums. Higher coverage means higher premiums but also ensures better financial protection for your loved ones.

- Term Length: The length of the insurance policy term also influences your premiums. Longer terms may have higher premiums but provide coverage for a more extended period.

Ways to Save Money on Life Insurance

When it comes to life insurance, there are several ways you can save money on premiums while still ensuring you have adequate coverage. By being strategic and informed, you can make the most out of your life insurance policy without breaking the bank.

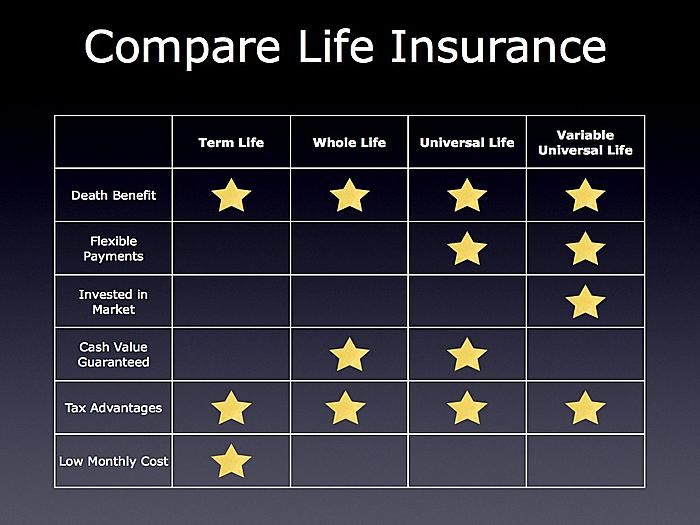

Comparing Different Types of Life Insurance Policies

- Term Life Insurance: This type of policy offers coverage for a specific period, typically 10, 20, or 30 years. It is usually more affordable than permanent life insurance.

- Whole Life Insurance: Provides coverage for your entire life and includes a cash value component. Premiums are typically higher but remain level throughout the policy's duration.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits. It allows for adjustments based on your financial situation.

Impact of Medical Exams on Insurance Costs

Medical exams are often required by insurance companies to assess your health and determine your risk level. The results of these exams can directly impact your insurance costs. To prepare for a medical exam and potentially lower your premiums, consider the following:

- Maintain a healthy lifestyle with regular exercise and a balanced diet.

- Avoid tobacco and excessive alcohol consumption.

- Stay up to date with regular check-ups and screenings.

- Provide accurate information during the application process to avoid discrepancies.

Utilizing Online Tools and Resources

Online tools and resources play a crucial role in simplifying the process of comparing life insurance quotes. These platforms provide easy access to multiple quotes from various insurance companies, allowing individuals to make informed decisions based on their needs and budget.

Exploring Online Platforms for Comparison

- Online platforms like Insurify, Policygenius, and NerdWallet offer a user-friendly interface to compare life insurance quotes.

- Users can input their information only once and receive multiple quotes from different insurance providers, saving time and effort.

- These platforms often provide detailed information about each policy, including coverage options and premium rates, helping users make an informed choice.

Using Online Calculators for Estimation

- Online calculators available on insurance websites can help individuals estimate their insurance needs based on factors like age, income, debts, and dependents.

- By inputting this data, users can get an idea of the coverage amount they require and the corresponding premiums they may have to pay.

- Calculators can also factor in inflation and other variables to provide a more accurate estimate of insurance needs over time.

Benefits of Independent Insurance Agents vs. Online Tools

- Independent insurance agents offer personalized guidance and expertise in navigating the complexities of life insurance policies.

- Agents can provide tailored recommendations based on an individual's unique circumstances and financial goals, which online tools may not account for.

- On the other hand, online tools provide a quick and convenient way to compare quotes from multiple insurers without the need for face-to-face interactions.

- Ultimately, the choice between using independent agents or online tools depends on personal preferences, comfort level with technology, and the complexity of one's insurance needs.

Conclusion

In conclusion, mastering the art of comparing life insurance quotes can lead to substantial savings and better coverage. Armed with the knowledge from this guide, you can confidently navigate the process and secure a policy that meets your needs.

Frequently Asked Questions

What factors can impact life insurance premiums?

Age, health, occupation, lifestyle, coverage amount, and term length are key factors that can influence life insurance premiums.

How can I save money on life insurance?

You can lower premiums by maintaining good health, comparing different policy types, and preparing for medical exams to secure better rates.

Are online tools reliable for comparing life insurance quotes?

Online platforms offer convenience and transparency in comparing quotes, but using independent insurance agents can provide personalized guidance.