Exploring the realm of top-rated health insurance companies in Europe unveils a landscape of options and considerations crucial for individuals seeking optimal coverage. From historical roots to modern-day services, this guide delves into the intricate world of health insurance in Europe.

Overview of Health Insurance in Europe

Health insurance in Europe has a long history dating back to the late 19th century when various European countries started implementing social health insurance schemes. These initiatives aimed to provide affordable healthcare access to all citizens and ensure financial protection against medical expenses.

Having health insurance in European countries is crucial as it guarantees access to quality healthcare services without the burden of high out-of-pocket expenses. It also contributes to the overall well-being of individuals and helps in maintaining a healthy population.

Key Features of Health Insurance Coverage in Europe

- Universal Coverage: Most European countries have universal health coverage, ensuring that all residents have access to essential healthcare services.

- Comprehensive Benefits: Health insurance in Europe typically covers a wide range of services, including preventive care, hospitalization, prescription drugs, and specialist consultations.

- Cost-Sharing Mechanisms: Many European health insurance systems involve cost-sharing mechanisms, such as co-payments or deductibles, to ensure that individuals have a financial stake in their healthcare.

- Public vs. Private Options: In some European countries, individuals have the choice between public and private health insurance options, allowing for flexibility in coverage and provider selection.

- Regulated Premiums: Health insurance premiums in Europe are often regulated by the government to ensure affordability and prevent discrimination based on health status.

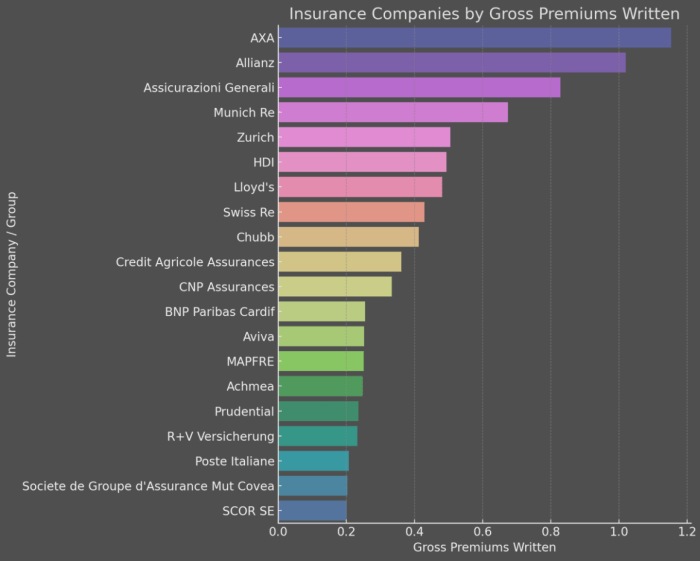

Top-rated Health Insurance Companies in Europe

When it comes to health insurance in Europe, there are several top-rated companies that stand out for their coverage, benefits, and services. Let's take a closer look at some of these leading providers:

Allianz

Allianz is a well-known insurance company in Europe that offers a range of health insurance plans to meet the diverse needs of customers. Their plans typically include coverage for hospital stays, outpatient treatments, and prescription medications. Customers appreciate the comprehensive coverage and excellent customer service provided by Allianz.

Bupa

Bupa is another top-rated health insurance company in Europe known for its flexible plans and extensive network of healthcare providers. They offer a variety of plans that cater to different budgets and healthcare needs. Customers praise Bupa for their quick claims processing and easy access to quality healthcare services.

Cigna

Cigna is a global health services company that operates in several European countries, offering a wide range of health insurance products. Their plans often include coverage for preventive care, specialist consultations, and mental health services. Customers appreciate the transparency of Cigna's policies and the ease of navigating their online portal.

AXA

AXA is a leading insurance provider in Europe that offers comprehensive health insurance plans with options for individuals, families, and businesses. Their plans typically include coverage for emergency medical treatment, diagnostic tests, and alternative therapies. Customers value the reliability and peace of mind that comes with having AXA as their health insurance provider.

Factors to Consider When Choosing a Health Insurance Company

When selecting a health insurance company in Europe, there are several key factors to consider that can greatly impact your coverage and overall experience. From cost and affordability to the network of healthcare providers, here are some important aspects to keep in mind:

Cost and Affordability

- Compare the premiums, deductibles, and co-payments of different health insurance plans to find one that fits your budget.

- Consider any additional costs such as out-of-pocket expenses and coverage limits when evaluating the affordability of a plan.

- Look for any potential discounts or incentives offered by the insurance company to lower your overall expenses.

Network of Healthcare Providers

- Check the list of healthcare providers associated with each insurance company to ensure that your preferred doctors, hospitals, and specialists are included in their network.

- Verify if the network is extensive enough to provide you with access to quality healthcare services in different locations or during emergencies.

- Consider the reputation and expertise of the healthcare providers within the network to ensure you receive optimal medical care when needed.

Regulations and Policies Impacting Health Insurance in Europe

In Europe, health insurance companies operate within a regulatory framework that aims to ensure the availability and quality of healthcare coverage for all citizens. These regulations and policies play a crucial role in shaping the health insurance landscape across different European countries.

Regulatory Environment for Health Insurance Companies

The regulatory environment governing health insurance companies in Europe varies from country to country. In some countries, health insurance is provided by the government as part of a universal healthcare system, while in others, it is predominantly offered by private insurers.

Regulations often dictate the minimum coverage requirements, premium pricing, and eligibility criteria for health insurance plans.

Impact of Policies on Health Insurance Availability and Quality

Policies implemented by governments can significantly influence the availability and quality of health insurance in different European countries. For example, policies that promote competition among insurers may lead to a wider range of health insurance options for consumers. On the other hand, policies that restrict insurance offerings may limit choices for individuals seeking coverage.

EU Regulations on Cross-Border Health Insurance Coverage

The European Union (EU) has introduced regulations to facilitate cross-border health insurance coverage within member states. These regulations aim to ensure that individuals can access healthcare services in other EU countries without facing significant financial barriers. EU regulations also address issues related to reimbursement for medical expenses incurred abroad and the portability of health insurance coverage.

Closing Notes

Concluding our exploration of top-rated health insurance companies in Europe, we have navigated through the key aspects of coverage, benefits, and customer feedback. This guide aims to empower individuals with the knowledge needed to make informed decisions regarding their health insurance needs.

Question & Answer Hub

What is the history of health insurance in Europe?

Health insurance in Europe dates back to the late 19th century, with Germany pioneering the concept of compulsory health insurance for workers.

Why is having health insurance important in European countries?

Health insurance ensures access to quality healthcare services without bearing the full financial burden, offering peace of mind and timely medical attention.

What factors should individuals consider when selecting a health insurance company in Europe?

Key factors include coverage options, network of healthcare providers, affordability, customer service, and reputation of the insurance company.

How do EU regulations impact cross-border health insurance coverage in Europe?

EU regulations aim to facilitate seamless health insurance coverage across European countries, ensuring individuals can access healthcare services even when traveling or residing in a different EU member state.